Renting an Apartment With a Low Credit Score: Tips and Tricks

Although people with a high credit score are not necessarily happier than those with a low one, they sure have fewer problems when it comes to renting. The cold truth is that renting with a bad credit score is hard.

Property management is a form of business, so there is no wonder why landlords prefer dealing with those who can prove their financial stability. Tenant credit and background checks are meant to reward responsible behavior, which is exactly what the majority of landlords are looking for.

And it becomes clear why landlords give their full attention to these 3-digit numbers and reject applications based on this factor. Like it or not, a bad credit score can get you a tough time qualifying for rent and halve your chances of renting the home of your dream. But it does not mean the war is lost. There are plenty of things you can do to minimize the destructive effect of a low credit score, and Rentberry is here to tell you how to rent an apartment with bad credit.

Where Do You Get a Credit Score?

There is a fair amount of brands that provide credit score services, but Experian, FICO, and TransUnion are three major credit bureaus on the US market. However, with platforms like Rentberry, you should not worry about trying hard to get your credit score report. Thanks to our partnership with TransUnion, your credit report will be generated automatically and delivered to your prospective landlord together with your application.

How your credit score for renting is calculated?

Your overall credit score depends on five factors: the length of credit history, credit mix, payment history, amounts owed, and new credit. But not all factors are equally important. The most critical ones are payment history and amount owed — they account for 35 and 30 percent accordingly. Your credit mix and new credit determine 10 percent of your score each, while the length of your credit history makes up the remaining 15.

However, as experts confirm, the percentage is never perfect and rarely adds up to 100. This can be explained by the fact that your score is constantly adjusting, and credit bureaus are not forthcoming with details. But what credit score do you need to rent an apartment?

What Credit Score Is Considered Low?

Before you grow alarmed, take the time to study a credit score chart. In most cases, the score varies between 300 and 850. And although there is no rule of thumb to determine the borderline between good and a bad scores, the majority of experts agree that everything below 650 can get you into trouble. In other words, the minimum score to rent an apartment will be around 700 and higher. This will be an acceptable credit score for renting.

Does a Bad Credit Score Affect Renting?

Yes, it does. Your credit history report is the only document that can give landlords an idea of your ability to pay rent on time. It demonstrates your financial responsibility and how good (or bad) you are at managing your finances, so this factor affects the final decision of landlords significantly. So, it’s time to reveal the secrets of renting with a low credit score.

Can you fix your credit score?

If you have first-hand experience of living with a low credit score, chances are good that this question has crossed your mind at least once. How can you increase a credit score? Here’s what a professional credit coach Jeanne Kelly says on whether you can or cannot repair your credit score:

“You can’t clear accurate information reporting on your credit reports, but you can make sure you have no errors on your credit report. 35% of your FICO score is based on the payment history. You can start today to make sure all accounts stay current to start your credit improvement.”

How can you build your credit score from scratch?

Let me use an analogy to answer this question. A high credit score is not a race car that allows you to hit the gas and feel the result right away. It’s more like your driving record. Instead of showing your current spot, it traces your past behavior. That’s why building a credit score takes time and effort. You can build one over time with a student loan, mortgage, or personal loan, just to name a few. Most importantly, remember to pay your bills on time and make sure your credit utilization is not higher than 30%.

According to the expert opinion, using credit cards on a regular basis can help tremendously in building credit scores:

“I always say use credit cards as a tool to build your credit history. If you look at credit cards as a way to build up your credit by paying on time, keeping balances low, in time you need a larger loan such as a home mortgage you have good history.”

Can your credit score be lost?

Your credit score is not material, which means you cannot lose it in the conventional sense. What you can lose, however, is your credit card. And it can negatively affect your credit score under particular circumstances. Once your card is lost or stolen, you get options to choose from. You can replace it, upgrade it, or close it entirely. And you should know about a catch with the last option. When you decide to cancel your credit card, your available credit amount decreases while the amounts owed get increased. As we’ve explained earlier, this factor is one of those determining credit scores.

Who can see your credit reports?

In fact, this question is strictly regulated by federal law. As stated in the Fair Credit Reporting Act, there’s a list of so-called ‘permissible purposes’ that allow others to obtain your credit report. Given this, the list of people who can see your credit report includes but is not limited to the following:

- Prospective landlord or property owner (only after your permission)

- Credit grantors (in case you’re applying for credit)

- Collection agencies (they need it to collect a debt)

- Insurance companies

- Employers (in case you gave them your permission)

Apart from the above-mentioned categories, your credit report gets accessible to everyone you decide to authorize. This can be your colleague, close friend, or family member. All it takes is written permission from you.

How to Rent with a Low Credit Score

1. Co-sign Your Rental Agreement

If you have a low credit score, your goal is to give your landlord extra reassurance that you will make a reliable tenant. The easiest way to do so is to find a co-signer, aka rent guarantor, to cover your back. It means that someone else will be legally and financially responsible for the property you rent. In most cases, people choose either close friends or trusted family members for the role of co-signers. It might be a hint at an obvious, but rent guarantors must have a good credit score of their own.

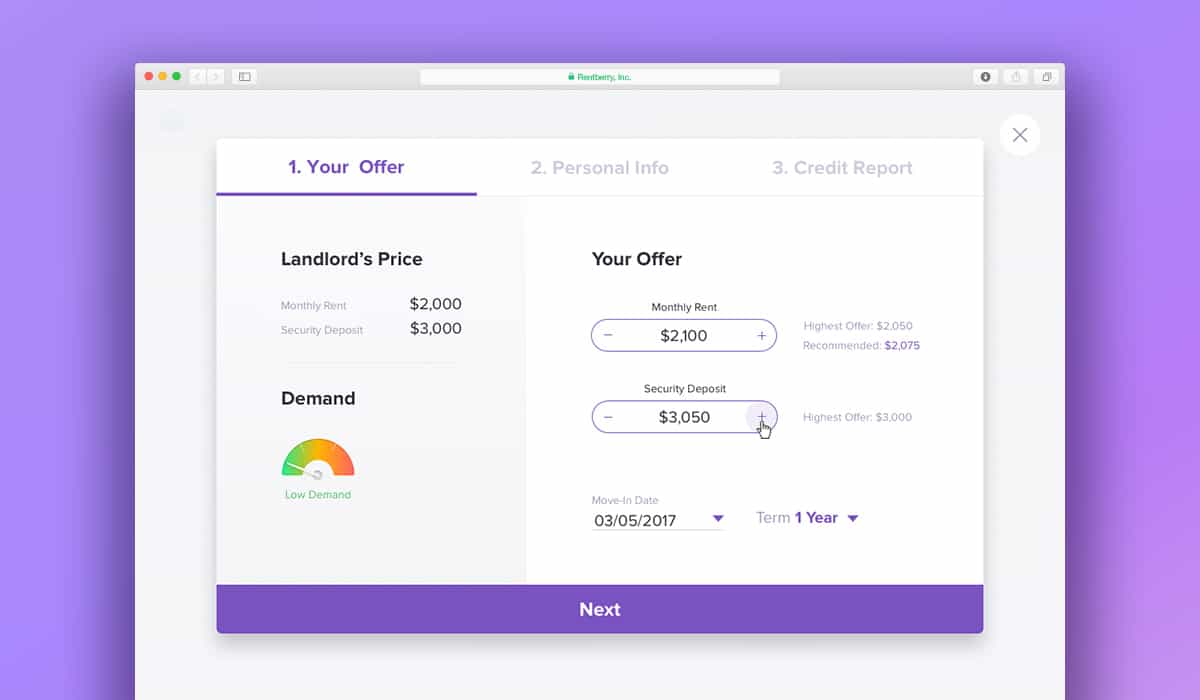

2. Make Your Landlord a Custom Offer

The cold truth is that the rental process is yet another auction. Although property managers are usually clear about the price, tenants are free to make custom offers (and the majority of them don’t miss this opportunity). Like it or not, bidding wars are exactly what is happening behind the scene of the rental world. But if you have a low credit score, you can actually take advantage of this trend. Choose a platform with an option of custom offers, and make your rental application more attractive by means of extra money.

3. Offer a Higher Security Deposit

The other way to prove your financial solvency is to pay a larger security deposit. This approach will make you more appealing in the eyes of your future landlord and can sweeten the deal. Of course, some rental properties might have exceptionally strict rules regarding security deposits, but it doesn’t happen frequently.

3. Provide a Positive Reference

Another trick to make your landlord look past the numbers is to convince your former landlord to vouch for you. If you have a lengthy rental history and have always been a responsible tenant, use it for your own benefit. Asking your previous property manager for favorable feedback will sure pay off. Positive testimonials never hurt anyone, so give it a try.

More like this: Renting Apartments With Low Income [Or No Income at All]

4. Set Up an Automatic Deduction From Your Bank Account

All landlords want to be certain about getting payments in full and on time. To alleviate your landlord’s concerns, set up an automatic deduction from your bank account. Or, you can use an automatic payments feature if you pay your rent with Rentberry. If you are ready to pay rent on time (and hopefully you are), it will make no difference to you. However, it can be a good tactic to increase your chances of renting a property.

5. Show Your Progress and Be Honest

The truth is that a good tenant does not necessarily equal an excellent credit score. You might be the most responsible and trustworthy human being, but it does not guarantee you from losing a job or experiencing another form of a financial step back. Some things can get out of your control and ruin your credit history. If something like that happened to you, try acting upfront. Admit you have a bad score even before your landlord asks for it, and provide a reasonable explanation of your situation.

6. Demonstrate a Solid Income

Good credit history can reveal a lot about your money management skills and overall financial situation, but there are other showings to look for. Your credit history might be shaky, but a record of a stable income can cover things up. Use a letter from your employer, bank statements, documentation of tax returns, and recent pay stubs to demonstrate your financial muscle and your ability to pay rent on time.

7. Suggest Paying in Advance

It might be a costly option, but it does its job just well. The truth is that most property managers don’t care about the numbers in your credit score. What they actually care about is your ability to pay on time, and paying upfront demonstrates this ability better than anything else. By paying a few months’ rent in advance, you can easily alleviate your landlord’s concerns and rent that dream property of yours.

As you can see, there is no need to get nerve-wracked at the thought of your low credit score. Set aside some time and think of which ideas from this article can work for you. There is a fair amount of measures you can take to improve your tenant’s application and rent a new apartment despite a low credit score. Find a rent guarantor, demonstrate a stable income, offer a higher security deposit, pay in advance, or combine a number of ideas to get the property of your dream. Above all, remember that you are so much more than a 3-digit number.

I really enjoyed reading your information on renting with bad credit.

It gave me a clear understanding about how credit works.

I need help….

Im trying to get my son out OF hotels and back into our own place ive checked everywhere it seems like AND don’t know whether to give up or keep trying.?

I’ve been turned down left and right to where I’m not having any kind of faith left so please is there anyone out there that can help me find a home

Bad credit is not always a bad resume of that person it could be other issues they may have had like medical, the character of a person should be judged not their credit, you could have great credit but can have bad character about themselves and that makes bad tenants that will not take care of your property, smokers, drinkers. I have always taken care of every property I have stay at and the landlord loves it. It is hard for me to get into a place because my credit score is low, which has know bearing on who I am and what I am like. I take care of what I get, car, home what ever it is. If I did not have a major surgery back in 1998 I would not have low credit score.

Bad credit can trigger all sorts of issues, from difficulty securing a car loan to trouble getting a mortgage. But even if you’re just looking for an apartment to rent, your credit history can pose problems. If you are moving in near future, i suggest you start setting some money aside and begin looking for a new place as early as possible. The sooner you start looking, the more time you’ll have to prepare.